Investing is a journey full of lessons, and like many others, I’ve made my fair share of mistakes along the way. Looking back, these experiences have shaped my approach to investing and taught me invaluable lessons about risk management, patience, and strategy. Here are three key mistakes I’ve made in my investment journey and what I’ve learned from them.

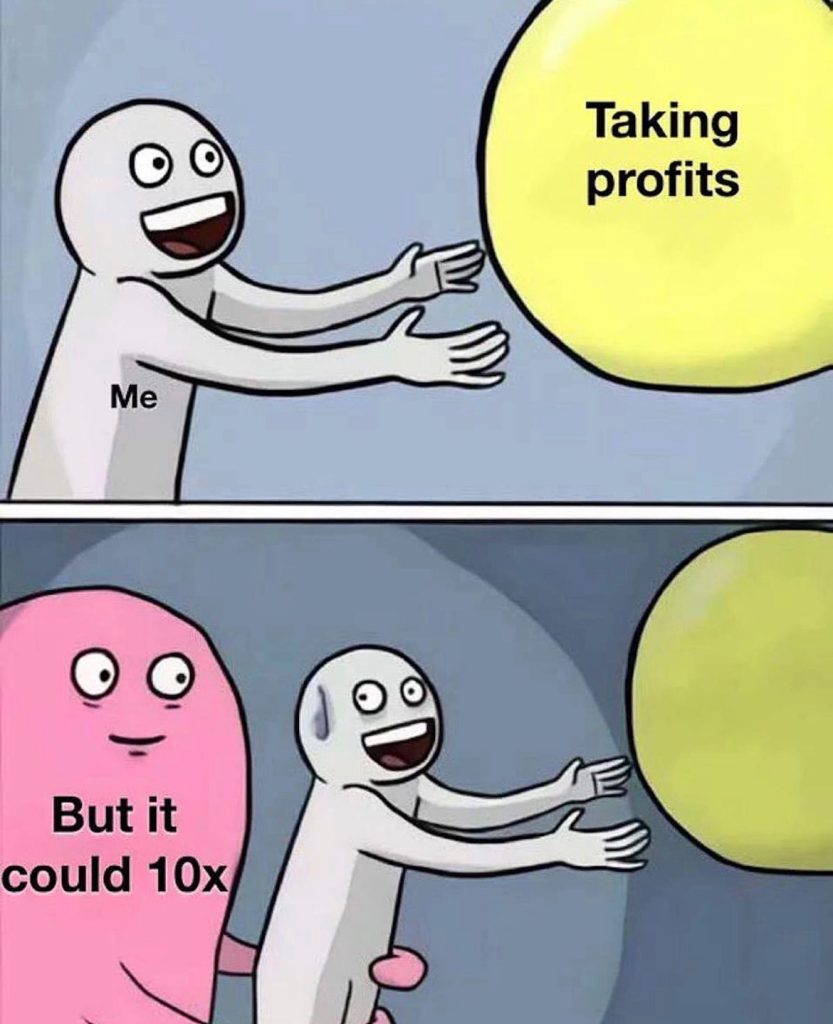

1. Not Taking Profits

In my early days of investing, I often fell into the trap of “holding out for more.” When the market was up, I felt the excitement of potential gains and ignored the importance of realizing profits. Unfortunately, markets are unpredictable, and gains can vanish as quickly as they appear.

The Lesson:

Set clear profit-taking strategies. Whether it’s selling a portion of your holdings at a target price or using a stop-loss order, having a predefined plan helps lock in gains and reduce emotional decision-making.

2. Using All Cash to Buy Investments

Another major mistake was going all in on certain investments. Driven by confidence in my research or the fear of missing out (FOMO), I would often allocate all my cash into a single asset or group of assets, leaving no room for flexibility. This approach left me exposed to unexpected downturns and missed opportunities when the market presented better deals later.

The Lesson:

Always keep some cash on hand. A cash reserve not only serves as a safety net during market downturns but also allows you to seize opportunities when they arise. Diversifying your allocation between cash, stocks, and other assets is essential for managing risks.

3. Over-Diversifying My Portfolio

While diversification is a key principle in investing, I took it to the extreme by spreading my investments across too many assets. This led to a portfolio that was difficult to manage and diluted any significant gains. Instead of focusing on a few high-conviction investments, I ended up with a scattered strategy that underperformed.

The Lesson:

Focus on quality over quantity. A well-thought-out portfolio with fewer but stronger investments often outperforms a portfolio with too many positions. Concentrate on areas you understand deeply and avoid over-diversifying for the sake of “playing it safe.”

Moving Forward

These mistakes were not failures but opportunities to learn and grow as an investor. Today, I approach investing with a clearer mindset, better strategies, and the humility to keep learning. For anyone starting their investment journey, remember: mistakes are inevitable, but how you respond to them defines your success.

What are some lessons you’ve learned from your own investing experience? I’d love to hear your stories in the comments below!